Deal price over 60 times yearly profit – L’Oréal Acquire Aesop

The Nikkei released 4/5 that L’Oréal reached an agreement for Aesop acquisition.

Following is the link of the release.

日本ロレアル、仏ロレアルとナチュラ・アンド・コーが「イソップ」の買収に合意 – 日本経済新聞 (nikkei.com)

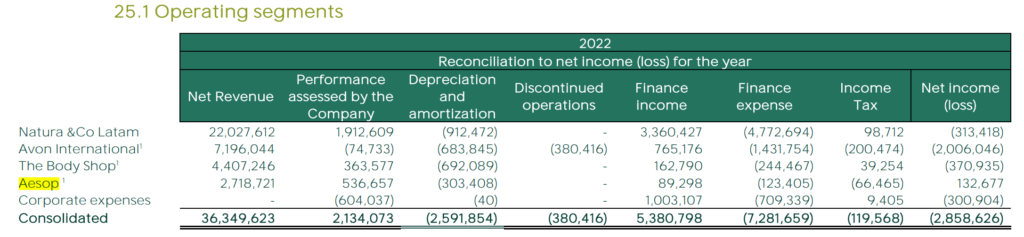

In this blog, looking at deal price quickly. According to the Nikkei, Aesop 2022 sales is $537M and the deal price is $2,525M. The latest 2022 annual report for Natual and Co, Net income 132,677 and income tax is -66,406, so net income before tax is 199,083. Revenue is 2,718,721, so the profit rate is about 7.3%, which multiple $537M is $39M. Annual report and the link is as follows.

dcbb6f43-8279-2e1f-dddf-2c28f3bb010f (mziq.com)

Considering above, deal price divide by yearly profit is about 64.4, which means that it takes almost 64 years to pay back. Therefore, the deal price is extremely high compared with normal M&A, why ?

The reason is of course, L’Oréal is confident to yield much more profit than now, how ?

One key point is China market and according to the Nikkei, L’Oréal is interested in China market, so maybe this is one of the keys to achieve high profit.